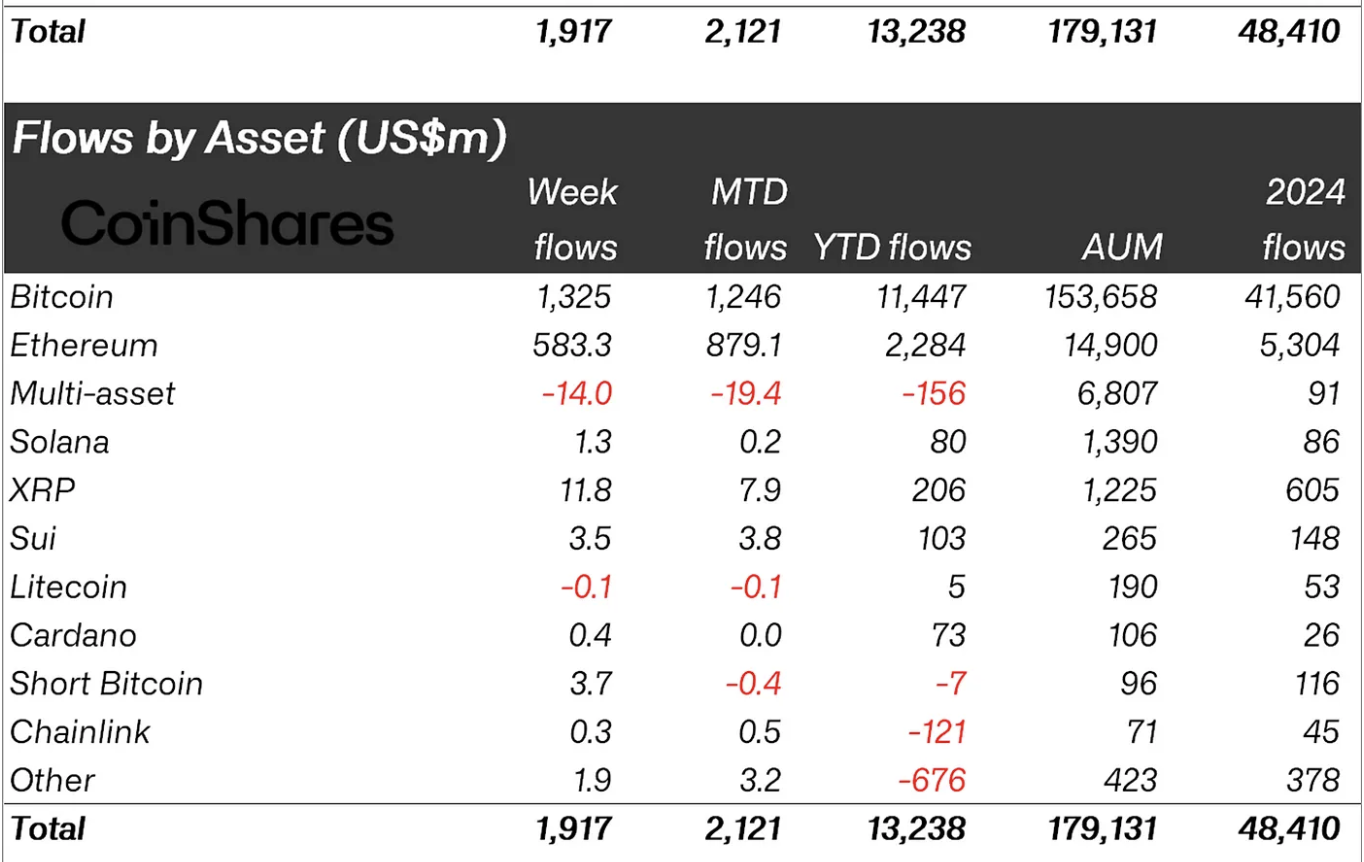

Bitcoin approaches a critical resistance level while Ethereum and XRP post gains as institutional investors poured $1.9 billion into digital asset products last week, marking the ninth consecutive week of positive inflows.

Bitcoin traded at $108,205 on Tuesday, up 2.5% and within striking distance of $108,450 — a technical threshold that analysts say could trigger a move to new all-time highs. The cryptocurrency has gained over 4% since Friday’s low of $102,664.

“If it can break and hold above $108,450 we’ll target all time highs soon,” crypto trader Wick said in a social media post Monday.

Ethereum saw its strongest institutional week since February with $583 million in inflows. The second-largest cryptocurrency broke above key moving averages as assets under management for Ethereum products reached $14.9 billion.

XRP surged 6% to $2.32 after Purpose Investments launched Canada’s first spot XRP ETF on the Toronto Stock Exchange. The Purpose XRP ETF began trading on Tuesday under ticker XRPP, providing North American investors with direct exposure to the cryptocurrency. Weekly inflows into XRP-related products hit $11.8 million.

The broader crypto market showed signs of strength despite ongoing geopolitical tensions in the Middle East. Bitcoin’s derivatives market reflected growing confidence, with open interest surging to $72 billion and trading volume jumping 28% to $58 billion.

Analyst CryptoCon highlighted a rare back-to-back Hash Ribbons buy signal for Bitcoin. “This, in combination with low volatility, has never failed to produce a good run,” he said.

Digital asset investment products have now recorded $13.2 billion in year-to-date inflows. Bitcoin attracted $1.3 billion of last week’s total, while multi-asset products saw minor outflows of $14 million.

The global cryptocurrency market cap climbed 2.5% to $3.4 trillion. Other major cryptocurrencies posted mixed results, with Solana gaining 3.6% and Dogecoin rising 2.9%.

QCP Capital noted in a market update that “Bitcoin’s resilient price action appears underpinned by continued institutional accumulation.” Major firms like Metaplanet and Strategy have continued to buy during market dips, while spot Bitcoin ETFs have recorded their seventh straight week of inflows.

The convergence of technical breakouts, institutional flows, and regulatory progress is creating what many traders see as the setup for the next major leg higher across all three major cryptocurrencies.