But if you want something with a bit more flexibility. Here are five apps that will fill all of your trading tracking needs:

Investing.com: Stocks & News

The critical feature of any stocks app is the ability to get a quick overview of your portfolio. Or, if you’re not investing, the stocks you care about. Investing.com’s Android app takes that one step further by offering an excellent snapshot of market conditions beyond the symbols you’re tracking. With real-time quotes for some 70 global exchanges. A unique calendar that keeps you apprised of the economic events that are happening around the world.

You’ll also get Investing.com analysis opinions to help guide your trades, a steady stream of news broken down by category. You can easily share and save articles on your different apps and your Facebook page. You can quickly access recently viewed quotes by swiping them up on the drawer at the bottom of the screen. Switching between light and dark themes. The free app will display a banner ad at the bottom of the screen. You can remove it by paying $20 a year.

Stocktwits – Stock Market Chat

For example, on the day of an earnings report, Stocktwits will not only show you what was reported. It’ll also tell you how investors are reacting to how the stock is performing in the after-hours. In contrast, most other apps will simply say that the market is closed. Of course, you can use Stocktwits to get a quick quote. Still, its real value is understanding why a particular stock is moving or not. As well as spotting any trends that you might want to watch. Even if you don’t have a dime on the market, you won’t be able to look away.

Robinhood: Stocks & Crypto

Whereas other brokerage houses charge a fee for every trade offered. With a confusing set of rules for how and when you can buy and sell stocks. Robinhood does it all for free with little fuss. When you find a stock you like, just hit the Buy button. Enter the number of shares you want, and hit the green check mark. Then you need only swipe up to complete the trade. It’s about as easy as buying an app from the Play Store. If you use Stocktwits, you can link your accounts to buy as soon as you see a killer deal.

Acorns: Save & Invest

How it works is simple. Once you link your checking account, Acorns will round up your purchases, investing the difference a few cents at a time. For example, if you generally buy a latte at Starbucks for $3.73 each day. Acorns will take $0.27; invest it based on your chosen set of parameters. How long do you want to invest, your goals, etc.? It’ll cost a dollar a month; trades will be carried out as often as you’d like. Of course, you can also buy and sell the old-fashioned way, but really, what’s the fun in that?

Note that Acorns doesn’t let you buy or sell specific stocks; you invest in one of Acorn’s exchange-traded funds (ETF). If you want to do long-term investing in the broad segments of the market, it’s great. But if you want to buy 10 shares of Tesla or something like that, you’ll need to look elsewhere.

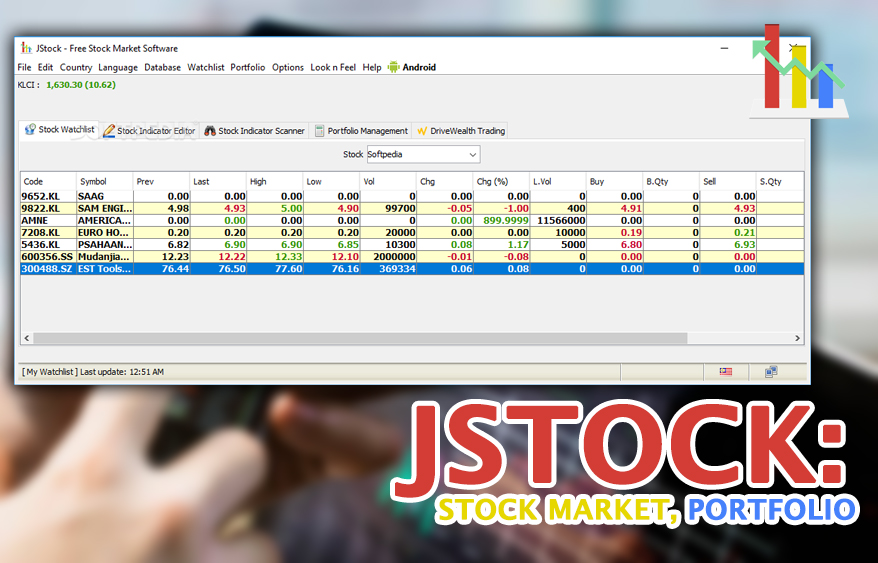

JStock:Stock Market, Portfolio

If you’re just looking for an easy way to track the companies you care about, you can’t go wrong with JStock. Minimal yet still packed with information. The app will dutifully keep tabs on your stocks, providing expert analysis of every quote. Simple and efficient, JStock will put your favorite stocks and indexes at your fingertips. So you can see exactly when it’s time to buy or sell.

You can track what you’ve bought and sold and set alerts for target prices. And select which news source you prefer, all while syncing everything back to Windows, Mac, or Linux computers. But it’s with world index charts where JStock excels. Offering a customizable snapshot of an entire exchange. The app lets you dial into charts precisely, setting the moving averages and viewing daily candlestick lines. Track the markets’ open, high, close, and color-coded performance going back 10 years. Even if you don’t quite understand it, it’s fascinating.