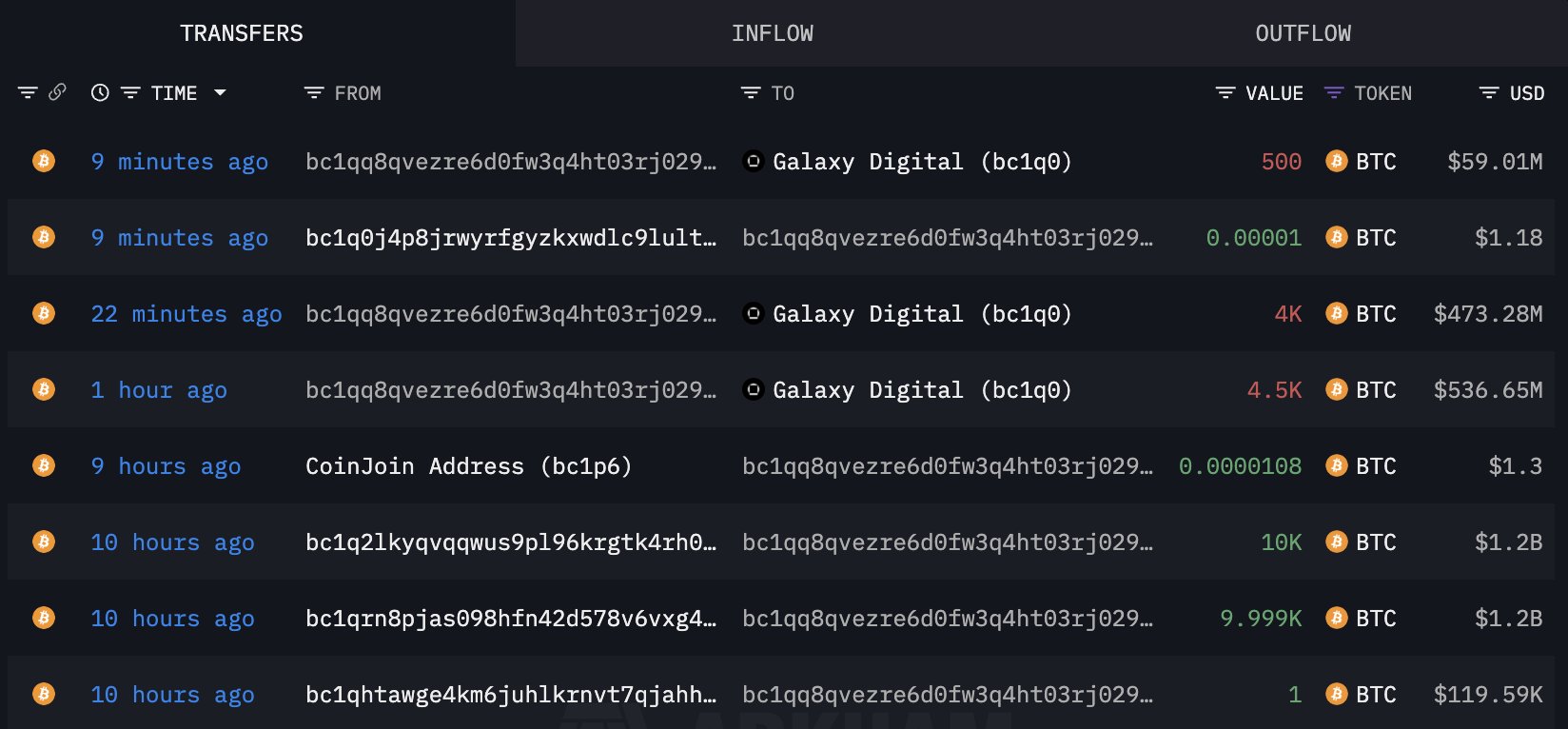

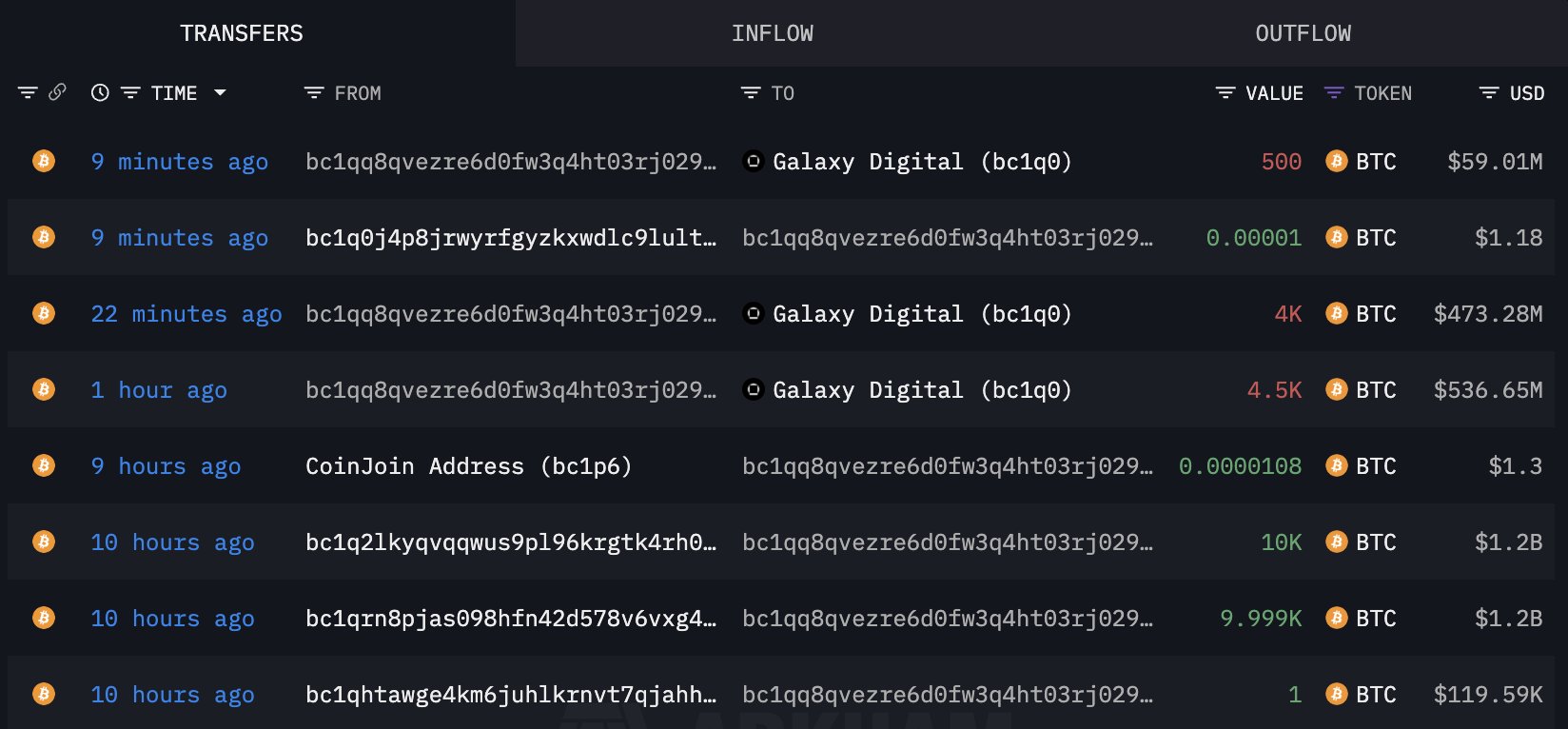

A Bitcoin wallet dormant since 2011 sold 9,000 BTC worth $1.06 billion through Galaxy Digital on July 15, causing Bitcoin’s price to plummet by 4.33% and wiping out $406 million in leveraged positions within hours.

The mysterious holder, who originally mined Bitcoin when it traded for just $0.78, executed the massive sale after Bitcoin hit an all-time high of $123,019 on July 14. The transaction represents one of the largest single sales by a so-called “Satoshi-era” whale.

Source: Lookonchain

Bitcoin’s price crashed from its record high to $116,364 in less than 24 hours. The broader cryptocurrency market followed suit, with total market capitalization dropping 3.56% to $3.68 trillion.

The sale triggered widespread liquidations across cryptocurrency exchanges. Long positions worth $406 million were automatically closed as prices fell below traders’ margin requirements.

OnChain School, a blockchain analytics firm, characterized the move as deliberate market manipulation.

The wallet, identified as “bc1qm” by blockchain tracking service Nansen, had remained completely inactive for 14 years. It still contains approximately 71,000 BTC worth over $8 billion at current prices.

Galaxy Digital facilitated the transaction through over-the-counter trading, a method that typically reduces market impact by avoiding public exchanges. However, portions of the Bitcoin subsequently appeared on major exchanges, including Binance and Bybit.

According to EmberCN, an on-chain analyst, the movement to Galaxy Digital signals the whale may intend to sell additional holdings. The institutional approach suggests sophisticated profit-taking rather than panic selling.

The sale generated extraordinary returns for the early Bitcoin adopter. With an original cost basis of $0.78 per Bitcoin, the 9,000 BTC sale alone produced gains exceeding 2.4 million percent.

Edo Farina, Head of Social Adoption at XRP Healthcare, warned that the Satoshi-era bags were “just a distraction.” He noted that centralized exchanges hold significantly more Bitcoin distributed across multiple wallets, likely to destabilize the market or drive down sentiment.

The sale occurred during “Crypto Week” in Washington, where legislators are considering three key cryptocurrency bills. President Trump’s endorsement of the legislative efforts had previously boosted market confidence.

“The rally is supported by strong ETF inflows, long-term holder demand, and rising expectations of a favorable policy shift in Washington,” said Iliya Kalchev, dispatch analyst at digital asset platform Nexo.

Bitcoin recovered partially by midday Tuesday, trading above $118,000 as its 14-day Relative Strength Index eased below overbought levels. Trading volume surged 37% to over $150 billion as investors assessed the whale’s intentions.

The incident demonstrates how individual holders from Bitcoin’s earliest days retain significant influence over the modern cryptocurrency market, despite its $2.4 trillion valuation.