Smartphones have made it easy to send nearly anything to your friends acquaintances: messages, pictures, files, even live video of whatever you’re looking at. But transferring a little cash to your buddy with your phone? Until recently, that has been a bit of a hassle. Some recent apps have made passing a few bucks person-to-person a little easier.

Mobile-to-mobile payments are already part of everyday life in some developing countries, but they’re just coming into their own in the U.S. The latest crop of personal payment apps are pretty impressive, however. You can repay friends request cash with nothing but your phone, usually with neither person paying any kind of fee. Here are a few apps that are, dare I say it, better than cash.

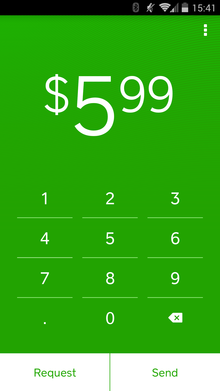

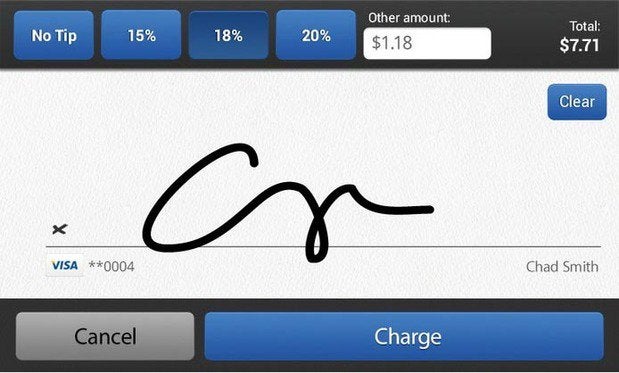

Square Cash

Square Cash is nothing if not straighforward.

This is currently the killer app when it comes to paying back friends, buying small favors, or requesting the cash that’s owed you. There are no fees (below $250), the app is simple clean, you don’t even need the app to use it, really. Cash comes from the same Square that made charging credit cards as simple as plugging in a free reader into a headphone jack. It’s an interesting “hack” of the debit card system, but all you really need to know is: it works.

You need a debit card, access to email, enough money in your checking account. Sending or requesting Square Cash is basically sending an email to your friend, with a CC to [email protected], the amount to send as a the subject (“$5.99”). l the app really does is pre-format that email make sure it went through. If neither of you have used Square Cash before, Square securely snags debit card details from both of you. If either of you have sent Square Cash before, it’s near-automatic.

I’ve used Square Cash to pay friends for parking, cookies, lunch, small purchases, other items at least two dozen times, only encountered a strange verification error once. It is as it is labeled: basically cash.

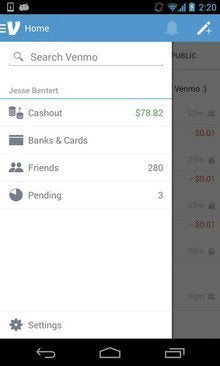

Venmo

Venmo requires a bit more setup than Square Cash.

One step more buttoned-up than Square Cash is Venmo. The positive difference is that it’s a bit easier to find the person to which you’re trying to send money. The downside is that it requires a bit more setup on both sides.

ke Square Cash, Venmo takes money from your checking account (directly or via debit card). You can technically set up a credit card, too, but that incurs a 3 percent fee for the sender, so better to keep that as a backup. Unlike Square Cash, you have to do a bit of setup with your bank account before sending receiving; the service deposits two micro-transactions of into your account, you must verify the amounts. Once set up, it’s relatively simple to pay people in your phone contact list, pay off group restaurant tabs, cash out payments you’ve received.

Venmo goes out of its way to assure you of the security of your accounts transactions. At the same time, it makes it very easy to tweet, share on Facebook, or Venmo-broadcast your activity to friends. st make sure your settings are in order, your bank all set up, it is a rather simple app to use for payments.

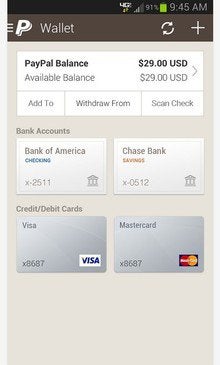

yl on Android

The best thing about yl is that everyone knows it has an account already.

You, most of those who have bought anything on eBay or through a small online shop, know the yl drill. th its Android app, yl tries to make person-to-person payments a tad simpler.

As with yl on the web, yl allows you to send payments to “Friends or Family” for free, as long as they’re coming from a bank account or a stored yl balance. If you’re paying for “Goods or Services,” or with a credit card, there’s a fee. If you’re paying for a good or service from a friend or family, well, it’s up to you to split those hairs. Most anyone with a smartphone probably also has a yl account set up, so it’s fairly likely you can pull up their contact, send, get your guilt out of the way. us you can quickly pay at small merchants a few big-box stores (including Home Depot) that offer yl Here checkout

If you your friend are touting phones with NFC, you both have the yl app installed, you can open up yl tap phones together to move the money around. It’s a simple enough process, it has a well-designed flow—one that makes you wonder why they can’t get the mobile folks to work on the main yl website. On the other side of speed ease, you can ask yl to verify each transaction with you by SMS, passcode lock the app, more. Given the widespread knowledge of the yl name br, it is the most familiar way you might pay someone back, even if they don’t have the yl app installed.

The main drawback to yl payments is inherent to yl itself: it’s probably not your primary bank account, it can take 3-4 days to get that money from yl over to your bank accounts (if you remember to transfer it at all). And there are the occasional, confounding freezes on pay-outs that come with yl transations. Thought if yl is common familiar to your financial life, yl paybacks could be convenient.

st-Resort Card Readers: Intuit Goyment, Square Reader, yl Here

Maybe your checking account is looking a little thin, or you’re owed a sizable sum from a friend who is also not prepared to make with the instant transfer. Credit cards are your last resort (other than extensive dish-washing lawn-cutting).

Intuit’s Goment lets anyone take credit cards, but there’s a fee.

Square’s reader can take payment from traditional credit cards, even if you’re just a regular old person, not a business. And they’ll even give you the reader for free. so free is Intuit’s Goyment reader service, yl Here. Both do a bit of credit checking on you, require a two-micro-payment verification of your bank account. After that, you take payments with either a swipe, or manual entering of a card, its CVV, the billing ZIcode.

None of these are great solutions, though, when the money due is due real soon: at meal’s end, on the way to a concert, when the bar tab comes due. They require setting up a merchant-like account carrying around a physical card reader, which is just one more thing to get lost in your bag. There are fees on the receiver, too: between 2.7 3.5 percent, depending on which service you use how you pay. But sometimes, getting the money now, with a small fee, is worth more than the no-fee payment your roommate swears is coming, just as soon as his b clears up its Tuesday-night fill-in gig.