How Does It Work?

Android Pay uses NFC communication to make a secure credit/debit card transaction between your smartphone and the payment terminal. And prompted to tap your phone on the payment terminal at the counter.

Your default card will be used to extract the money. Depending upon the system, you may have to enter your card number on the payment terminals’ keypad. You’ll get a notification after the transaction is finished. But paying with your phone can be faster.

Which Banks Work with Android Pay?

There’s an extensive growing list of supported banks and credit card companies, so if you’re with one of the larger institutions. You should be able to get going without any problems. Several regional banks and credit unions have been added. You’ll want to check the details. Wells Fargo, for example, works with Visa, MasterCard, and co-branded cards in partnership with a bank. Or another retailer for rewards points. If your card is one of the lucky ones, tap Add a credit or debit card. You’ll be prompted to scan it and enter the three-digit code on the back.

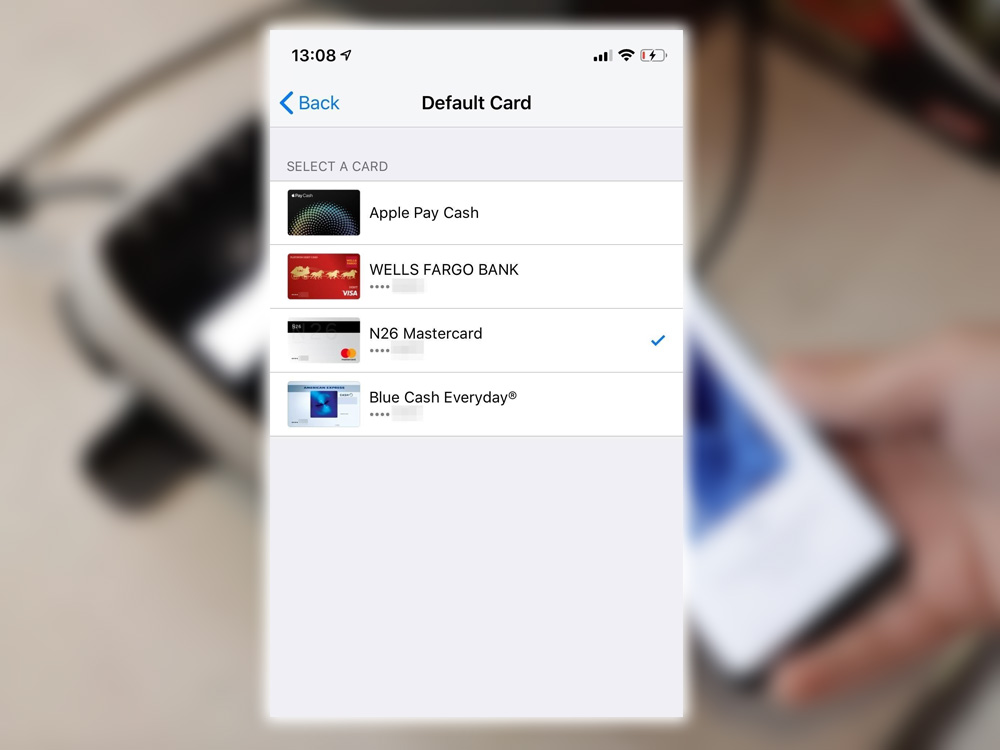

Android Pay handles multiple cards and allows you to choose which one to use as the default. If you’re running an Android 7.1 device. You can use an app shortcut to jump right to a specific card. If you want to use that for a particular transaction.

If you have multiple cards, there’s probably one you use more than the others. You can set that card as the default. Touch that card inside the Android Pay app, scroll down, and select Set as the default card.

This is the same spot where you can remove a card if you’re no longer with that bank.

What Phones Does it Work With?

Android Pay works with Android phones running KitKat 4.4 and above that, including NFC. Most major budget smartphones that have been released in the last few years. Have this but double-check the spec sheet on your device to ensure you’re good to go. Check your phone Settings to see if NFC is enabled. Ensure it’s flipped on to go with Android Pay. A fingerprint sensor is not required. Otherwise, unlock your phone with its pin or pattern to make a transaction.

Where can I Use It?

Android Pay is accepted anywhere the symbol is displayed:

Anywhere that takes contactless payments will work for you. Note that you’ll sometimes see the contactless payment symbol on a payment terminal; check that you can use Android Pay.

What About in-app Purchases?

Yes, Android Pay will work there, also. For example, Uber, Dunkin Donuts, and more can connect your payments from their app through Android Pay.

The default Android Pay card is debited. The advantage of using Android Pay is that you don’t have to reenter your credit card information for each app. Where you’re likely to spend money. In-app payments with Android Pay are app-by-app basis. The list includes some of the most popular retail service apps.

How About on the Web?

Yes, Android Pay can work with merchants that support this feature. You’ll need to be using Google for supported merchants.

Google says that Groupon.com 1-800-Flowers.com support the feature, but more are always coming. Google has long included a capability to save a credit card. But this goes further by tying online payments directly to Android Pay.

So is Android Pay Different from the Wallet?

In 2018, Google Wallet merged with Android Pay.

How was it Different from Apple Pay?

Apple Pay required a retailer with a specific terminal supporting Android Pay; any NFC terminal didn’t necessarily do it. Apple Pay only worked with iPhone 6 and above. On Android, a number, password, or pattern worked if you had a phone that didn’t have a fingerprint sensor. Apple Pay also lets you pay with the Apple touch. At the same time, Android Pay didn’t initially support tapping your watch to the payment terminal.

What about Compared to Samsung Pay?

The primary claim to fame for Samsung Pay was that, in addition to NFC. It could use Magnetic Secure Transmission MST. Which allows you to pay with your phone at terminals that don’t support NFC. It tricks the swipe-your-card reader into thinking it has swiped your Samsung Pay card. The downside was that it only worked with a limited number of Samsung smartphones. Like the Galaxy S6 variants, Galaxy S7 variants, and Note5. It then worked with the Gear S3 watch, as well.

Is it Secure?

Android Pay sends a virtual account number without sharing the credit card details. The significant difference between Apple’s payment techniques was that Apple Pay used a Secure Element. Which lived on a physical chip inside the phone for storing encrypted financial data. Android Pay, just as Wallet did, used Host Card Emulation. In fashion, this meant encrypted information was in the cloud.

Android Pay would require you to have a screen lock on your phone. So that no one could swipe your phone and then start racking up your card. However, you should always use reasonable security practices to monitor your account to ensure that nothing inappropriate has occurred. Because retailers get a one-time use token to a virtual card, your actual credit card details are safe. If hackers compromise the retailers’ payment system, they can’t steal anything useful. So paying with Android Pay is far more secure than using your credit card.

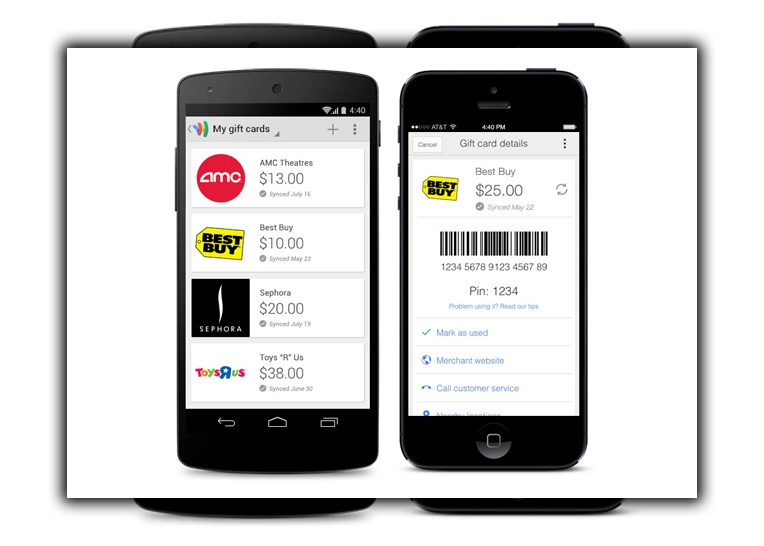

How Do I Add a Gift Card?

Touch the floating action button, then add a store gift card. Search for the store, which is probably on the list if it’s a significant chain. If the card is for a small store not in the database, you’ll need to hold onto it. However, if you’re adding a card for something like Best Buy or Target. You could scan it and have a digital copy inside your Android Pay app. Expect a push notification when you are in or near the store where you can redeem it.

Good tip, delete it after you have used the gift card. Otherwise, you’ll receive perpetual notifications even after you’ve used up the balance.

How Do I Add a Loyalty Card?

The process is very similar. Touch the floating action button, find your store, then scan the card. You’ll then have a digital barcode at the ready with the details of your loyalty program. So you can ditch that giant keychain full of loyalty cards.

The app will ping you when you enter a store where you’ve registered a loyalty program. This way, you can swipe down to show the card from the home screen. Most retailers now take your phone number. Which can serve as a reminder that you should rack up points with your purchase.

Does it Work with Android Wear?

At that point in 2016, all you would get was a notification that you had made a payment. Or when you entered a store where you could use Android Pay. There were rumors about only being able to pay with your wrist piece Apple Touch-style. You waited for the release of Android Wear 2.0. It is now the 2020s. And very happy to say you can use your Android Wear with the Android Pay app.