For some, CyanogenMod is just another Android fork in the road. But for Cyanogen, its open-source operating system is the foundation of a burgeoning empire, there are no plans to sell it off anytime soon.

A report published by The Information Thursday claims that Cyanogen recently turned down a $1 billion acquisition offer from . The startup apparently told its shareholders that it “declined to pursue the matter” because its barely had the chance to take off, now it’s “seeking a valuation close to $1 billion.”

Experts told me that waving off ’s advances are in the company’s best interests—even with a super-fat paycheck sitting on the table. Of course, it helps that Cyanogen has already established partnerships with hardware companies like Oneus Oppo. The Information also reported that Micromax is Cyanogen’s next hardware partner, which just recently launched its first Android One device.

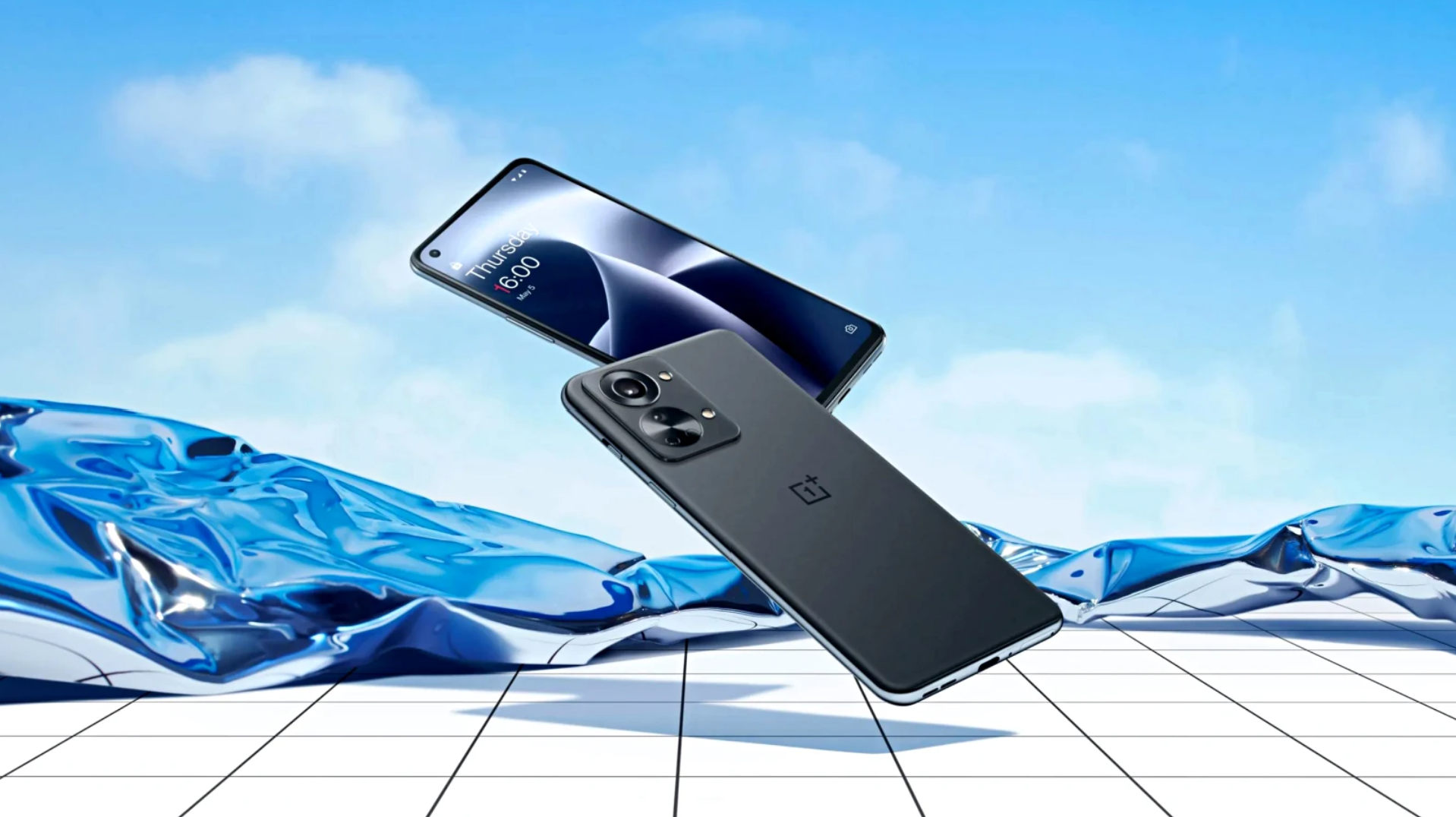

Cyanogen tried its own efforts at marketing a flagship with the Oneus One.

For its part, Cyanogen is mostly staying mum on the topic. Abhisek Devkota, Cyanogen’s head of developer public relations, told me that the company’s “priorities haven’t changed—we are working to build the best OS possible for our users.” He then added that, respectfully, that Cyanogen isn’t commenting on the latest rumors.

Regardless of the validity of the report, analysts agree that turning down an acquisition puts Cyanogen on the right path. Carolina Milanesi, of Research at tar rldpanel, notes that The Information says Cyanogen turned down the deal to keep Android open, but believes there’s more to the story—specifically, that Cyanogen has other potential buyers lined up.

“They seem to have secured Micromax to manufacture devices for them, with more whitebox vendors like Micromax getting better bigger, they might have a shot in the short term to grow their presence market value,” Milanesi told me in an email.

Cyanogen could have also turned down ‘s offer to better realize its opportunity in emerging markets, like China. ll Stofega, the ogram Director for Mobile Device Technology Trends at IDC, believes that pursued Cyanogen because of its presence there. “’s not making much there,” he said. “Most people are using [AOS, isn’t getting the ability to track their information.” Stofega went on to say that roughly 50 to 70 percent of Android users in China aren’t actually using licensed versions of the operating system. “In other words, you’re not running any applications,” he said.

Stofega also expressed optimism about Cyanogen’s future. ”ople have argued that is trying to shut it down,” he said. “I would argue that if you’re a company that’s looking to get out from under the Android footprint, if you can get a search engine, a navigation program, a couple of other things, you’re in a pretty good space.”

This is basically what Nokia did, taking ’s AOS forking it into its own operating system to sell in emerging markets. “ere Nokia went wrong, they didn’t quite have that app store part of it figure out,” said Stofega. “If [Cyanogen] plays it right, there’s definitely a place for a company that is able to go to market offer a different type of Android experience.”

Fortunately for Cyanogen, it has a healthy relationship with —or at least it did. The Oneus One, which is technically Cyanogen’s first flagship smartphone, is equipped with the apps suite that comes stard with all -blessed Android devices. But we may soon see a change in the relationship between the two companies.

ether attempted to woo Cyanogen with an acquisition is still just hearsay at this point in time, as neither Cyanogen nor will comment on the matter. “ssica ssin [of The Information] has a good track record,” said iel e, an analyst at Canalys. “But I think there needs to be some natural skepticism about this rumor.”